Kvants Vaults Close July 2025 With 22% Net Return As Onchain Capital TVL Explodes, Public Access Launch Begins

ROAD TOWN, British Virgin Islands, Aug. 27, 2025 (GLOBE NEWSWIRE) -- Kvants has announced the official public launch of its Vaults product, following July 2025 results that delivered a 22% net return. The milestone underscores the platform’s ability to generate consistent, risk-adjusted returns while limiting downside exposure, positioning Vaults as a smarter alternative to speculative trading or passive holding.

DeFi Yield Strategies Deliver Institutional-Grade Returns

From March 2023 to March 2024, outsized gains were often driven by speculative meme coins. Today, achieving 100x returns is increasingly rare without pure luck, as the market shifts toward analytics, on-chain data, and smart wallet tracking. In this new environment, traditional buy-and-hold strategies have proven insufficient. Holding altcoins outside of Bitcoin over the past 4 years has failed to consistently deliver new highs or stable returns, highlighting the need for structured, risk-managed approaches.

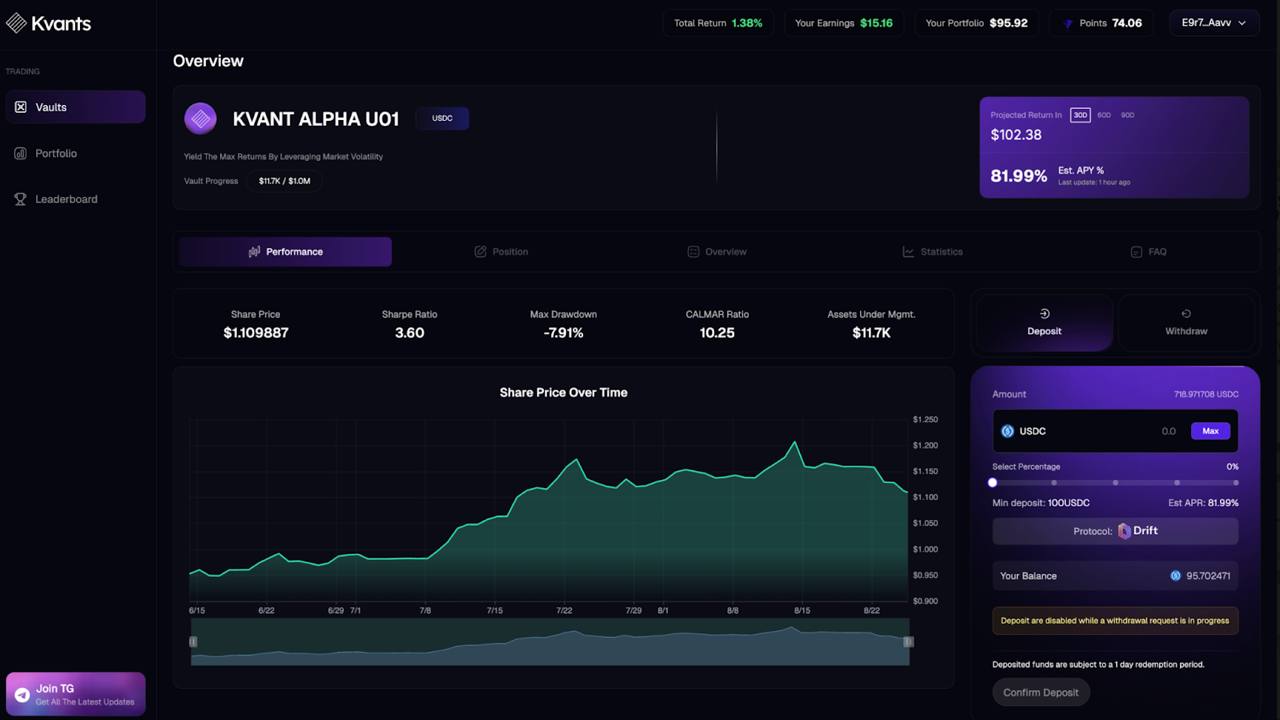

Kvants Vaults are designed to address this gap. By combining quantitative allocation models with on-chain execution, Vaults provide investors with diversified, actively managed exposure that achieves positive risk-adjusted performance, targeting Sharpe ratios above 3. The July performance illustrates this capability, with Vaults delivering over 20% returns while maintaining discipline in risk management.

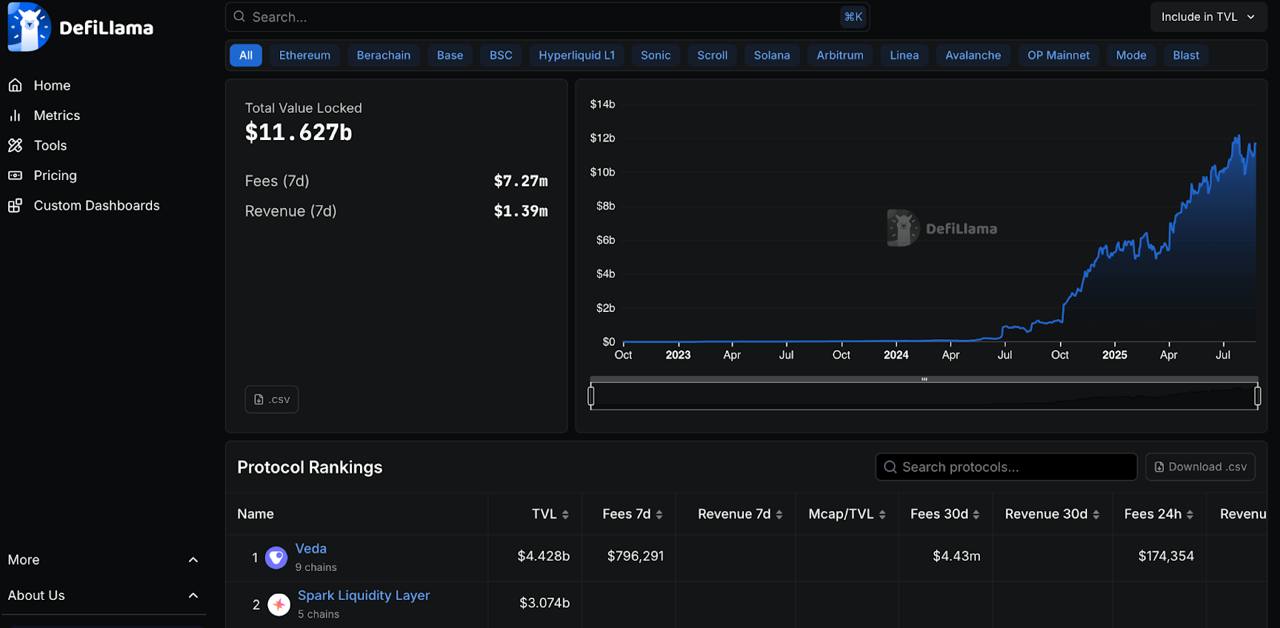

Onchain TVL Growth Signals Rising Confidence in DeFi Allocators

The market is rotating into structured on-chain investing. DeFiLlama’s Onchain Capital Allocator shows TVL around $11.78B, signaling strong demand for verifiable, algorithm-driven allocation. Capital is moving from speculative altcoins to transparent, automated, risk-controlled vaults with real-time performance. As retail and institutions adopt this discipline, quant-driven on-chain platforms are set to capture a larger share of assets and define new standards for capital efficiency.

A Crypto Portfolio Diversification Tool for Stability and Growth

The core purpose of Kvants Vaults is to offer investors a reliable diversification tool that balances performance with protection. Unlike speculative strategies or passive holding, Vaults are structured to reduce drawdowns while still participating in market upside. For example, during a recent downturn, Bitcoin declined nearly 10%, while Kvants Vaults limited losses to just about 1%. This downside protection enables investors to remain exposed to digital assets without being subjected to the full volatility of the market.

Vaults consistently provide smoother returns with far less downside risk. This tradeoff positions it as a long-term allocation tool for investors seeking growth without the stress of constant trading or the instability of speculative bets.

Kvants Vaults, The New Era of Digital Asset Investments

The launch of Defi Vaults reflects a broader narrative: the digital asset market is maturing, and so too are the strategies required to navigate it. Investors are moving away from chasing high-risk tokens and toward structured products that combine diversification, transparency, and institutional-grade controls. Kvants Vaults represent this new era of investing, offering a practical solution for individuals and institutions who lack the time or appetite to actively trade but still seek exposure to crypto growth.

With returns that exceed 20% net and proven downside protection, Vaults provide a risk-adjusted path to participating in digital assets. This makes them particularly compelling for investors who value capital efficiency and a risk-adjusted rate of return.

Future Roadmap for Kvants Vaults and Investors

Looking ahead, Kvants will expand its Vaults offering to cover multiple investment themes and risk profiles, including stablecoin yield optimization, cross-chain liquidity provisioning, and tokenized treasuries. The aim is to give investors a menu of strategies that can be tailored to specific portfolio objectives, ranging from conservative yield to higher-beta growth.

Check Out Available Vaults Strategies

Connect With Us

Telegram

Twitter

About Kvants

Kvants is an AI-powered quantitative asset management platform that brings hedge-fund grade, market-neutral strategies to defi. It is led by a team of portfolio managers and quant researchers with decades of combined experience across tier-one institutions, including JP Morgan and Citigroup, and by hedge fund managers who have collectively overseen more than $1.4B in assets. The team’s background spans systematic derivatives trading, risk modeling, market microstructure, and on-chain execution, with a track record of building rules-based strategies and robust risk frameworks. This blend of traditional finance discipline and crypto-native engineering positions Kvants to set the standard in DeFi.

Contact:

Mona

info@kvants.ai

Disclaimer: This content is provided by Kvants. The statements, views, and opinions expressed in this content are solely those of the content provider and do not necessarily reflect the views of this media platform or its publisher. We do not endorse, verify, or guarantee the accuracy, completeness, or reliability of any information presented. We do not guarantee any claims, statements, or promises made in this article. This content is for informational purposes only and should not be considered financial, investment, or trading advice.Investing in crypto and mining-related opportunities involves significant risks, including the potential loss of capital. It is possible to lose all your capital. These products may not be suitable for everyone, and you should ensure that you understand the risks involved. Seek independent advice if necessary. Speculate only with funds that you can afford to lose. Readers are strongly encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.Neither the media platform nor the publisher shall be held responsible for any fraudulent activities, misrepresentations, or financial losses arising from the content of this press release. In the event of any legal claims or charges against this article, we accept no liability or responsibility. Globenewswire does not endorse any content on this page.

Legal Disclaimer: This media platform provides the content of this article on an "as-is" basis, without any warranties or representations of any kind, express or implied. We assume no responsibility for any inaccuracies, errors, or omissions. We do not assume any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information presented herein. Any concerns, complaints, or copyright issues related to this article should be directed to the content provider mentioned above.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c5233e29-e864-4e78-bcf4-fe64585ca07f

https://www.globenewswire.com/NewsRoom/AttachmentNg/b55f3774-04ef-4bb2-90e1-0b7201d4a357

https://www.globenewswire.com/NewsRoom/AttachmentNg/9741334b-43a8-437d-a9eb-a8e24514711e

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.